- Just Open and try - Trade-Simulator

- The program will load with an interface containing several tabs

Trade Simulator is a web application for simulating stock exchange trading. The program allows you to:

- Load historical ticker data

- Practice trading strategies in playback mode

- Place buy/sell orders and stop orders

- Track profit, loss, and drawdown on your account

- Analyze trading results

p.s. Project uses IguanaCharts library for charting.

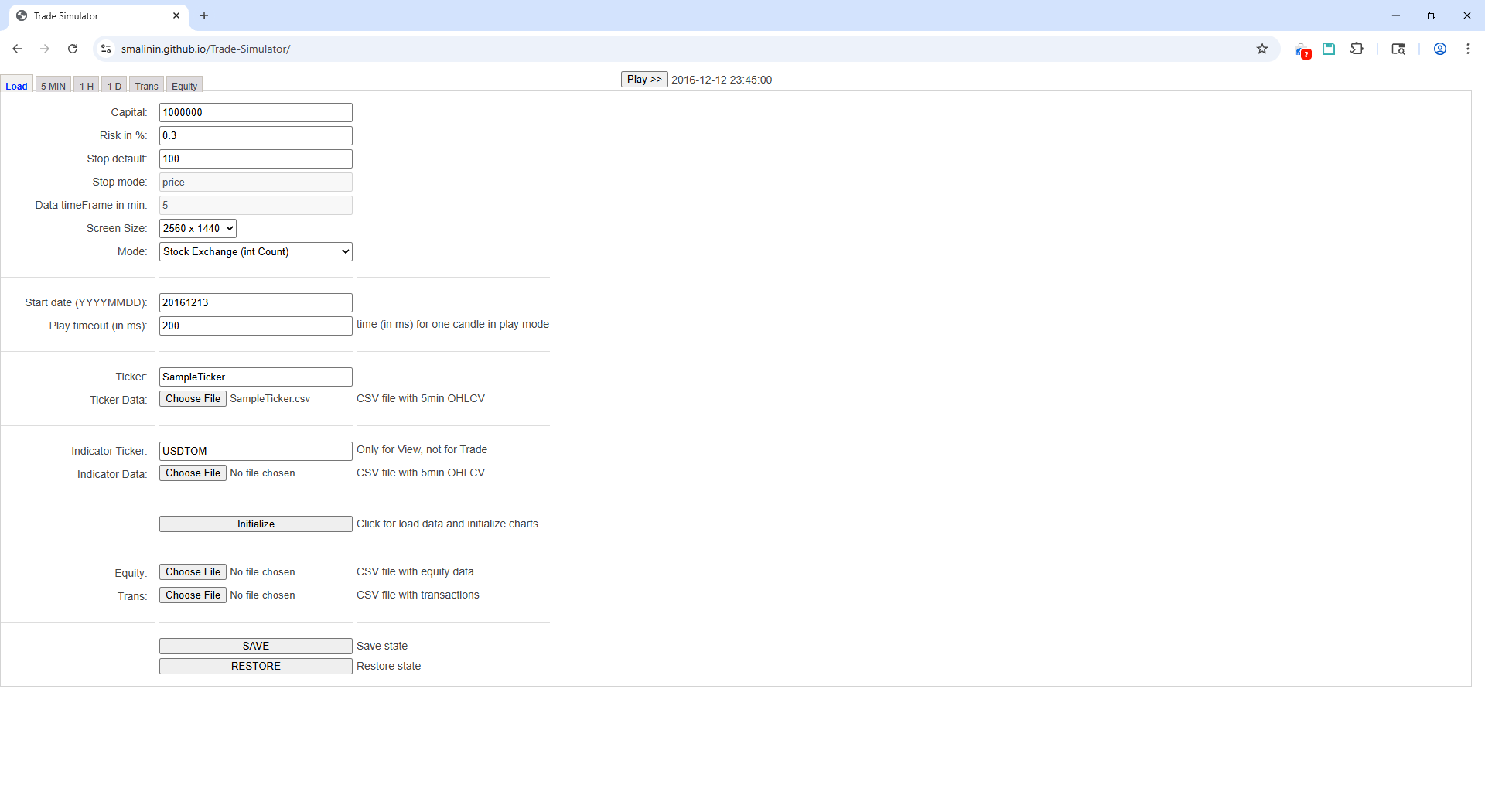

This is the main tab for initializing the program. Here you configure trading parameters and load data.

-

Capital — initial amount of money in the account (default: 1,000,000)

- The simulation starts with this amount

-

Risk in % — percentage of risk from capital per trade (default: 0.3%)

- Used when calculating position size

-

Stop default — default stop-loss in points (default: 100)

- Applied when calculating the stop

-

Stop mode — stop calculation mode (disabled, value: "price")

- Reserved for future use

-

Data timeframe in min — data timeframe in minutes (disabled, value: 5)

- Reserved for future use

-

Screen Size — screen size (default: 1980x1080)

- Affects the scaling of the interface and charts

- Available options: 1980x1080 (FHD), 2560x1440 (2K)

-

Mode — trading mode (default: Stock Exchange)

- Stock Exchange (int Count) — stock exchange, quantity in whole numbers

- Crypto Exchange (float Count) — crypto exchange, quantity in fractional numbers

-

Start date (YYYYMMDD) — simulation start date (default: 20161213)

- Format: YYYYMMDD (year-month-day)

- Example: 20220101 = January 1, 2022

-

Play timeout (in ms) — one candle playback time (default: 200 ms)

- The lower the value, the faster the simulation

- In Play mode, the program updates data at each timeout

-

Ticker — main ticker for trading (default: Si)

- Example: MSFT, APPL and etc

-

Ticker Data — load CSV file with data for the main ticker

- Must contain OHLCV data (Open, High, Low, Close, Volume) in 5min format

- Required CSV format (with semicolon separator):

or

DATE;TIME;OPEN;HIGH;LOW;CLOSE;VOLUME 20161017;1000;65300,0000000;65430,0000000;65263,0000000;65339,0000000;40 20161017;1005;65301,0000000;65319,0000000;65260,0000000;65294,0000000;418 20161017;1010;65297,0000000;65313,0000000;65290,0000000;65302,0000000;29 20161017;1015;65328,0000000;65328,0000000;65325,0000000;65325,0000000;50Datetime,Open,High,Low,Close,Volume 2024.11.01 00:00,2521.71,2522.3,2516.22,2520.1,3779.23 2024.11.01 00:05,2520.1,2521.59,2517.48,2519.61,1910.82

-

Indicator Ticker — additional ticker for display (like NASDAQ)

- Used only for visualization, not for trading

-

Indicator Data — load CSV file with indicator ticker data

- Same format as the main ticker:

or

DATE;TIME;OPEN;HIGH;LOW;CLOSE;VOLUME 20161017;1000;1,0500000;1,0530000;1,0490000;1,0510000;1000 20161017;1005;1,0510000;1,0520000;1,0500000;1,0515000;1200Datetime,Open,High,Low,Close,Volume 2024.11.01 00:00,2521.71,2522.3,2516.22,2520.1,3779.23 2024.11.01 00:05,2520.1,2521.59,2517.48,2519.61,1910.82

- Same format as the main ticker:

-

Equity — load CSV file with account capital data

- Used to load a previous state or for analysis

- CSV format:

Date,Capital,DrawDown 2016-12-13 10:00:00,1000000,0 2016-12-13 10:05:00,1000100,0 ...

-

Trans — load CSV file with previous transactions

- Helps restore previous trading

- CSV format:

Date,Mode,Price,Count,Sum,Profit,DrawDown,Comment 2016-12-13 10:05:00,buy,67.234,100,6723.4,0,0,New position ...

-

[Initialize] — initialize the program with selected parameters

- After filling all fields and loading CSV files, click this button

- The program will load data and you can switch to other tabs

-

[SAVE] — save current state to browser local storage

- Auto-saves state when closing the browser

-

[RESTORE] — restore state from browser local storage

- Loads the last saved state

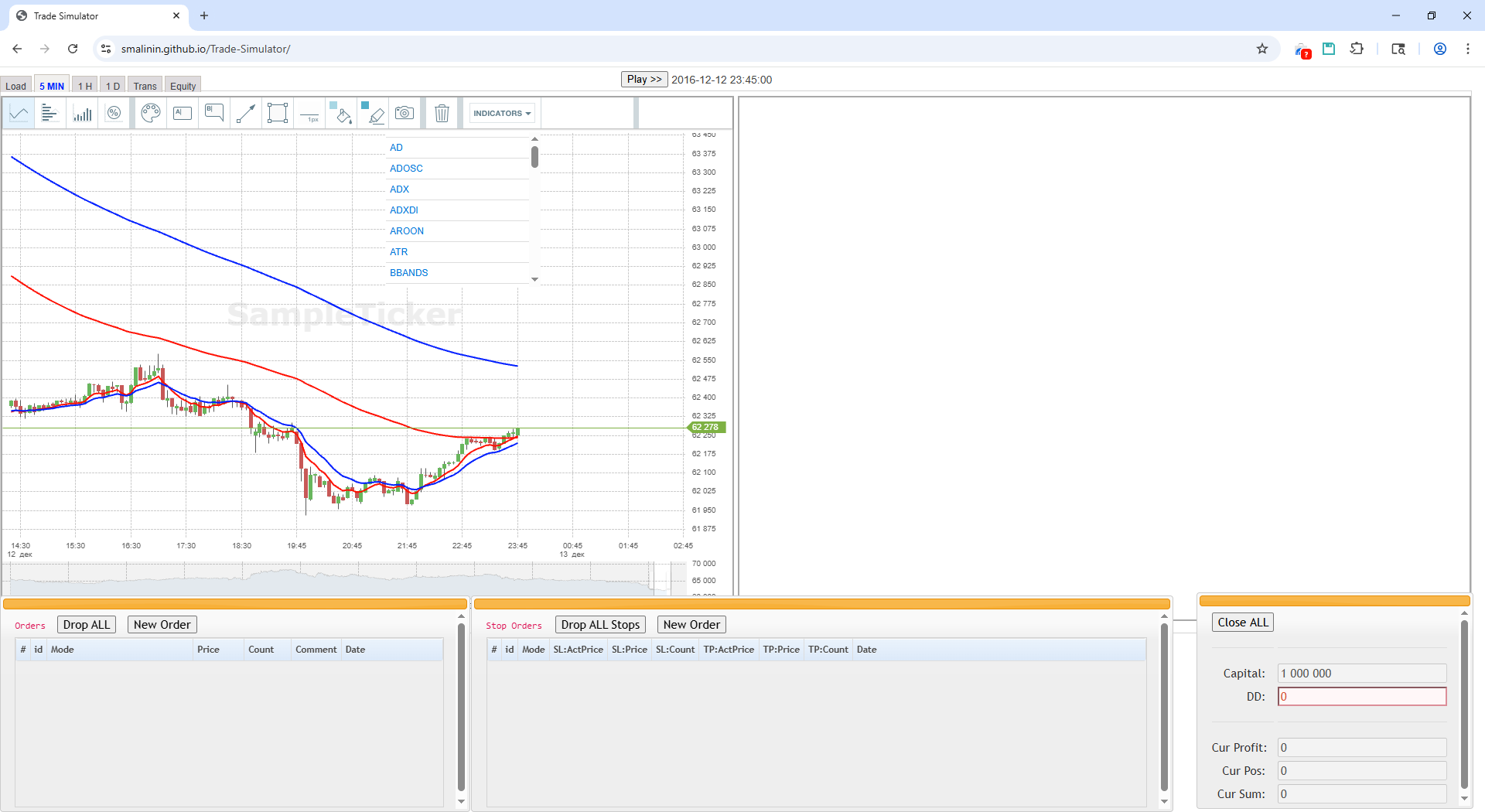

After clicking the [Initialize] button, chart tabs become available:

- 5 MIN — chart with 5-minute timeframe

- 1 H — chart with 1-hour timeframe

- 1 D — chart with 1-day timeframe

-

Two Charts Side by Side:

- Left chart — main ticker (for trading)

- Right chart — indicator ticker (for reference)

-

"Play >>" Button (top left):

- Click to start playing historical data

- During playback, the button becomes "Pause"

- Click again to pause

-

Current Date/Time (next to Play button)

- Shows the date and time of the current candle during playback

-

Left Order Management Panel (usually left of charts):

- Create new orders

- View and edit existing orders

- Set stop orders

Creating a New Order:

- Click on the desired price on the chart or use the "New Order" dialog

- Select type: Buy or Sell

- Specify price and quantity

- Click button to create the order

Editing an Order:

- Find the order in the current orders list

- Click on it to edit

- Change parameters and save

Deleting an Order:

- Select the order in the list

- Click "Delete" button or delete manually

Setting Stop Orders:

- After creating a main order, you can add stop-loss (SL) and take-profit (TP)

- SL (Stop-Loss) — order to close position at a loss

- TP (Take-Profit) — order to close position at a profit

Called when clicking the [New Order] button in the "Orders" panel.

Basic Parameters:

-

Mode — order type (Buy/Sell)

- Buy — purchase (green color)

- Sell — sale (red color)

-

Price — order price

- If left at 0, the order will execute at open/close price of the candle

- Two helper buttons:

- [Get Market] — inserts current ticker price into Price field

- [Calc Stop] — calculates stop amount using the formula:

The calculated Stop Activation price is inserted into the "Stop Activation" field

Stop = 2 × ATR(100) if Stop > Stop_default: Stop = Stop_default

-

Count — number of contracts/shares

- [Calc Count] button — automatically calculates quantity based on:

- Set risk level (Risk in % on Load tab)

- Stop activation price (from "Stop Activation" field)

- Formula:

Count = (Capital × Risk%) / (Stop Activation - Price)

- [Calc Count] button — automatically calculates quantity based on:

Stop-Loss Parameters:

-

Stop Activation — stop order activation price

- When price reaches this level, stop-loss will trigger

-

Stop — stop order execution price

- Price at which position will close when stop triggers

Take-Profit Parameters:

-

Profit Activation — profit order activation price

- When price reaches this level, take-profit will trigger

-

Profit — profit order execution price

- Price at which position will close when profit triggers

Additional:

- Comment — comment for the order

- Helps track the reason for creating the order

- Saved in transaction history

Execution:

- When clicking [Execute] button, the following will be placed:

- Main buy/sell order

- Stop-loss order (if Stop Activation and Stop are specified)

- Take-profit order (if Profit Activation and Profit are specified)

Called when clicking the [New Order] button in the "Stop Orders" panel.

Used to create additional BuyStop/SellStop orders.

Basic Parameters:

- Mode — stop order type

- BuyStop — buy stop order (green color)

- SellStop — sell stop order (red color)

Stop-Loss Part:

-

SL: Stop Activation — stop order activation price for stop-loss

- When price reaches this level, SL order will trigger

-

SL: Stop — stop order execution price for stop-loss

- Position closing price when SL triggers

-

SL: Count — number of contracts/shares for stop-loss

- Separate quantity for this order

Take-Profit Part:

-

TP: Profit Activation — profit order activation price

- When price reaches this level, TP order will trigger

-

TP: Profit — profit order execution price

- Position closing price when TP triggers

-

TP: Count — number of contracts/shares for profit

- Separate quantity for this order

Features:

- Stop orders trigger automatically during data playback (Play mode)

- You can create multiple stop orders for one position

- Each stop order independently tracks activation levels

Displayed in a separate window and shows:

-

Capital — current account capital size

-

DD (DrawDown) — maximum drawdown from capital peak

- Shows maximum loss from the start of trading

-

Cur Profit — current profit/loss of open position

-

Cur Pos — current open position size (in number of contracts/shares)

-

Cur Sum — current open position amount

-

[Close ALL] — close all open positions with one button and delete all unexecuted orders

- Convenient for quick position exit without creating a new order

Table of all completed trades:

| Field | Description |

|---|---|

| # | Trade number |

| Date | Date and time of trade completion |

| Mode | Type: Buy (purchase) or Sell (sale) |

| Price | Order execution price |

| Count | Number of contracts/shares |

| Sum | Trade amount (Price × Count) |

| Profit | Trade profit/loss |

| DrawDown | Drawdown at the time of trade |

| Comment | Trade comment |

[Save] Button — save transactions table to CSV file for further analysis

Table of capital change history:

| Field | Description |

|---|---|

| Date | Date and time |

| Capital | Capital size at that moment |

| DrawDown | Drawdown at that moment |

[Save] Button — save capital table to CSV file

- Prepare a CSV file with historical ticker data

- CSV format (with semicolon separator):

or

DATE;TIME;OPEN;HIGH;LOW;CLOSE;VOLUME 20161017;1000;65300,0000000;65430,0000000;65263,0000000;65339,0000000;40 20161017;1005;65301,0000000;65319,0000000;65260,0000000;65294,0000000;418 20161017;1010;65297,0000000;65313,0000000;65290,0000000;65302,0000000;29 20161017;1015;65328,0000000;65328,0000000;65325,0000000;65325,0000000;50Datetime,Open,High,Low,Close,Volume 2024.11.01 00:00,2521.71,2522.3,2516.22,2520.1,3779.23 2024.11.01 00:05,2520.1,2521.59,2517.48,2519.61,1910.82 - Important Points:

- Dates must be in ascending order

- Time must correspond to timeframe (10:00, 10:05, 10:10, etc. for 5min)

- Open

index.htmlin your browser - On the Load tab:

- Set Capital (initial capital)

- Set Risk in % (risk per trade)

- Choose Mode (Stock Exchange or Crypto Exchange)

- Set Start date (start date)

- Set Play timeout (playback speed)

- Load CSV file into Ticker Data

- (Optional) Load indicator ticker data

- Click [Initialize]

- Go to the 5 MIN tab (or 1H, 1D)

- Click Play >> button to start playback

- Place orders as data plays

- Monitor profit/loss in the Status dialog

- Go to Trans tab to view all trades

- Go to Equity tab to view capital history

- Save data with [Save] button on each tab

- On the Load tab click [SAVE]

- State will be saved to browser local storage

- On next opening, click [RESTORE] to restore

- Use data in candle form (OHLCV)

- Ensure timestamps are in ascending order

- Check that prices are in the correct scale (e.g., in kopecks for ruble)

Stock Exchange (int Count):

- Use for stocks, futures

- Quantity always whole number

- Example: 100 Gazprom shares

Crypto Exchange (float Count):

- Use for cryptocurrencies

- Quantity can be fractional

- Example: 0.5 BTC

- Play timeout: 100-500 ms for normal playback speed

- Risk in %: 0.3-2% depending on strategy

- Stop default: 50-200 points depending on volatility

- SL (Stop Loss): Activates at price, closes position with loss

- TP (Take Profit): Activates at price, closes position with profit

- Both order types trigger automatically during Play

- Play/Pause: Play >> button on each tab

- Close ALL: Button in Status dialog for quick position closure

- Chrome 60+

- Firefox 55+

- Edge 79+

- Safari 12+

Chrome or Firefox is recommended for best compatibility.

- Check CSV file format

- Ensure start dates are correct

- Try clicking [Initialize] again

- Make sure Play mode is enabled

- Check that order price is within current candle range

- Check stop-loss and take-profit setup

- Check if browser local storage is enabled

- Try clearing browser cache

- Avoid using private mode (may prevent saving)

The program uses the following libraries:

- jQuery 1.12.4

- UIKit

- jsRender

- PapaParse

- jQuery.qtip

- jQuery.easing

- jQuery-ui

- Hammer.js

- IguanaChart

The program is distributed under GPL 3.0 license

Version: 1.1